It was a difficult year for Walgreens Shoe Alliance (NASDAQ: WBA )With the stock down about 60% in the last 12 months. The question for investors is whether this is a great buying opportunity or if there is more downside ahead.

Let’s take a closer look at why Walgreens stock has struggled and what the company can do to turn itself around.

Payment pressures and a weak acquisition

The only major issue facing Walgreens is the drug reimbursement prices the company receives from pharmacy benefit managers (PBMs), which are organizations hired to keep health care costs down. PBMs act as intermediaries between drug companies, health insurers and pharmacies to help obtain discounted prices and rebates for drug companies and set the prices that insurance companies pay to pharmacies.

PBMs, meanwhile, are paid through an administrative fee as well as some price rebates from pharmaceutical companies and a spread between the price paid by the insurance payer and the pharmacy. Notably, however, the three largest PBMs are now all owned by insurance companies.

During the past decade, PBMs have exerted significant price pressure on pharmacies, including Walgreens. This has led to many margin cuts over the years. For example, Walgreens grew its gross margin from 28.2% in fiscal 2014 to 19.5% last fiscal year, which ends in August 2023. This means that for every sale it makes, it makes a small profit, in this case approximately nine percent. low points

In addition to the payment pressure, Walgreens also made a weak acquisition when it acquired a majority stake in VillageMD and then helped expand the company by buying Summit Medical. The owner of primary care medical clinics was unable to successfully expand beyond its original geographic footprint and was a drag on Walgreens’ operating results. Walgreens also recently disclosed that VillageMD is under $2.25 billion in secured debt that it provided the company.

How to set up a company

In a regulatory filing, Walgreens noted that it is evaluating its options regarding VillageMD, including a potential sale of the entire business. This would be the best option in my opinion. While Walgreens will undoubtedly lose money on each sale, it will add to that money-losing investment by subverting its majority stake.

For its core pharmacy business, the company has begun closing unprofitable stores across the country. This is a good move for several reasons. First, it will reduce costs by having fewer stores and less overhead. Second, while it will lose some revenue, it will likely retain more sales as customers move their business to other nearby locations. This should improve same-store sales and margins, as it handles more traffic volume under a smaller cost structure.

In the long term, the company still needs to try to reduce the pressure of continuous payments. On that front, Walgreens is talking to PMBs and payers to implement a cost-plus drug pricing model where it is paid based on the amount of services it provides. Ultimately, payment pressures will need to be reduced and new models considered because forcing pharmacies to pay is not good for anyone in the long run.

Is it time to buy the dip?

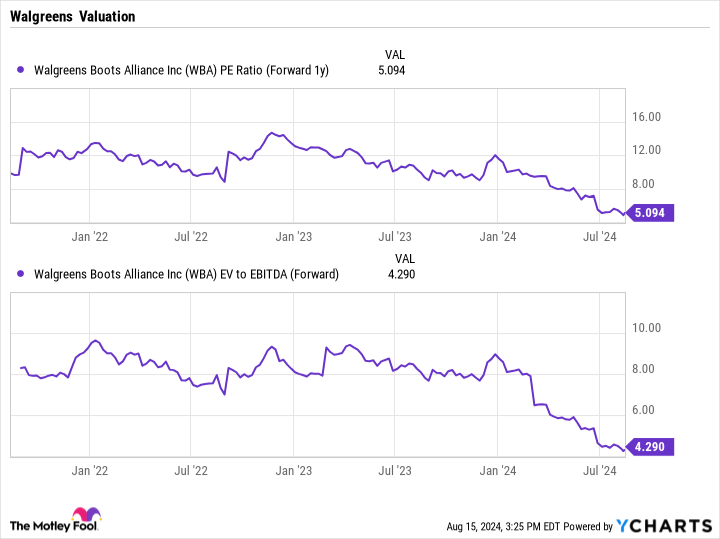

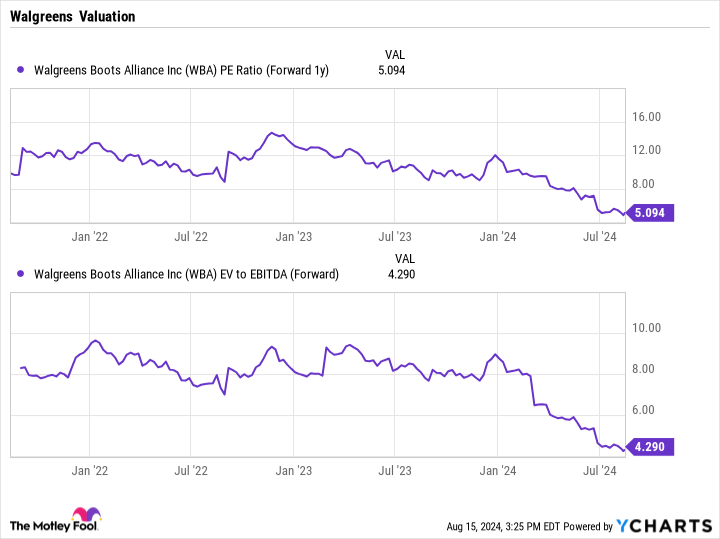

From a valuation standpoint, Walgreens is clearly on the clearance rack. It trades at less than 5 times earnings based on next year’s analyst estimates. Meanwhile, the stock trades at just 4 times enterprise value to EBITDA (earnings before interest, taxes, depreciation, and amortization), taking into account debt.

It’s cheap any way you look at it. That said, change takes time. The company needs to divest VillageMD, which, if it finds a buyer, will help reduce some of its debt. It then needs to optimize its store footprint and convince PBMs to implement a more efficient model than the one currently in use.

If it does these things, the stock may have more potential upside. If it cannot complete these actions, then the stock can become a value trap.

With that in mind, I would take a position in Walgreens because I think the company should eventually be able to see better days. However, I would keep the position small considering the potential risks.

Should you invest $1,000 in Walgreens Boots Alliance right now?

Before you buy stock in Walgreens Boots Alliance, consider this:

of the Motley Fool Stock Advisor The analyst team identified only what they believed 10 best stocks For investors to buy now…and Walgreens Boots Alliance was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia This list was created on April 15, 2005 … If you invested $1,000 at the time of our recommendation, You will have $763,374!*

Stock consultant Provides investors with an easy-to-follow roadmap for success, including a portfolio construction guide, regular updates from analysts, and two new stock picks every month. of the Stock consultant has service Four times more Return of the S&P 500 since 2002*.

View 10 Stocks »

* Stock Advisor returns to August 12, 2024

Jeffrey Seiler has no position in any of the listed stocks. The Motley Fool has no position in the stocks mentioned. Motley Fool has a disclosure policy.

With shares down more than 60%, is now the time to buy this healthcare stock? Originally published by Motley Fool

#shares #time #buy #healthcare #stock